Does Medicaid Cover Pull-Ons?

If you’re a Medicaid member diagnosed with incontinence, you may be wondering if the products you need, such as pull-ons, are covered by your Medicaid plan.

If you’re a Medicaid member diagnosed with incontinence, you may be wondering if the products you need, such as pull-ons, are covered by your Medicaid plan.

Getting the incontinence supplies you need can be difficult for people with lower incomes. However, if you’re a Medicaid recipient, you may be able to get adult briefs covered by your Medicaid plan.

If you’re a Medicaid member with incontinence, you’re probably wondering if bladder control pads are a covered benefit. The good news is, yes, most Medicaid plans cover incontinence supplies.

If you need more than one type of product, or an accessory product, we will need to speak with you to complete your order. Enter your phone number in the bottom left of the page and we’ll call you right now.

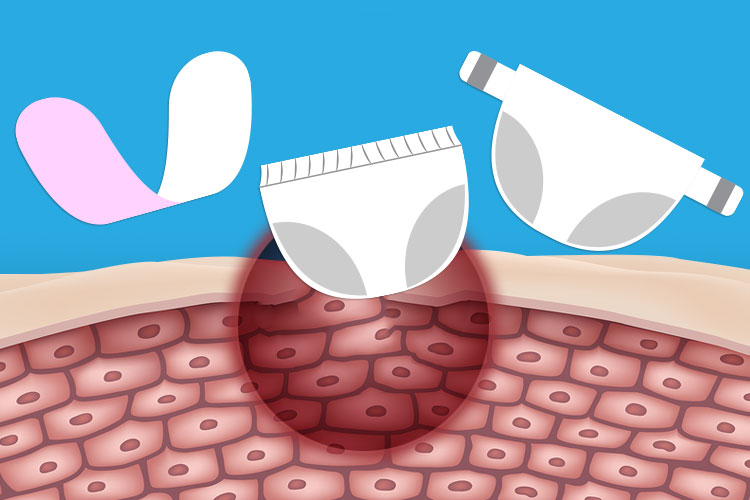

Good skin care is an essential part of staying healthy and protecting against illness and disease. It’s especially important for adults with incontinence, who are at greater risk of developing skin conditions.

s a doctor’s diagnosis all you need to get incontinence supplies covered by your Medicaid plan? If so, you’re in luck; Finding a doctor to diagnose incontinence is easier than you think.

There’s no arguing that healthcare is a challenging cost for senior citizens. Research suggests that the average senior citizen will need $280,000 to cover health expenses after age 65. But if you have Medicaid, that cost could be greatly reduced.

Providing care for someone with Alzheimer’s or Dementia can be challenging on a tight budget. Luckily, Medicaid provides many benefits that can make care more affordable.

The differences between Medicare and Medicaid are not simple. Each has many different plan options, including: Fee-For-Service, QMB, SLMB, Managed Care, and QI. So how do you know which one you have?

Ready to experience a faster, simpler, and more reliable way to get medical supplies with your insurance benefits? You’re in the right place.

Oct 1, 2022

Are you looking for a new doctor or primary care physician (PCP)? There are many reasons why you might decide you need to change doctors or healthcare providers. A new diagnosis or a change in your health status could be driving your search. Or maybe you recently moved to a new town and need a doctor near where you live. Perhaps your healthcare provider retired or maybe you just don’t “click” with your current doctor.

Sep 21, 2022

Do you live with diabetes? If so, you’ve probably heard about, or even considered using a Continuous Glucose Monitor. A Continuous Glucose Monitor, also known as a CGM, is a wearable device that lets you track your blood sugar without the need for frequent fingersticks.

Sep 14, 2022

Home Care Delivered is pleased to welcome Joseph Bidjoka, a healthcare focused investor and innovator, to the company’s leadership team as the Vice President of Mergers and Acquisitions.

Sep 8, 2022

Exercise. We’ve talked about it in this blog. Your doctor has probably recommended it. You may even be doing it. Many people with diabetes and pre-diabetes know that exercise is key to managing their condition. In fact, exercise in addition to diet, monitoring blood sugar levels, and taking insulin and other medications are key components of diabetes self-care and management.

Sep 7, 2022

Home Care Delivered, Inc. welcomes Robert S. Taylor to the company’s leadership team as the Senior Director of Sales Operations.

This website uses cookies so that we can provide you with the best user experience possible. Cookie information is stored in your browser and performs functions such as recognising you when you return to our website and helping our team to understand which sections of the website you find most interesting and useful.

Strictly Necessary Cookie should be enabled at all times so that we can save your preferences for cookie settings.

If you disable this cookie, we will not be able to save your preferences. This means that every time you visit this website you will need to enable or disable cookies again.

| Name | Provider | Purpose | Expiration |

|---|---|---|---|

| __cf_bm | .js.ubembed.com | This cookie, set by Cloudflare, is used to support Cloudflare Bot Management. | 1 hour |

| __cf_bm | .t.co | This cookie, set by Cloudflare, is used to support Cloudflare Bot Management. | 1 hour |

| __cf_bm | .7f1604e0d0d1485ca36e79084ccc71fe.pages.ubembed.com | This cookie, set by Cloudflare, is used to support Cloudflare Bot Management. | 1 hour |

| PHPSESSID | app.responseiq.com | This cookie is native to PHP applications. The cookie is used to store and identify a users' unique session ID for the purpose of managing user session on the website. The cookie is a session cookies and is deleted when all the browser windows are closed. | session |

| HCDOnline | HCD.com | We use this cookie for user authentication to our online portal systems. | Session |

This website uses Google Analytics to collect anonymous information such as the number of visitors to the site, and the most popular pages.

Keeping this cookie enabled helps us to improve our website.

Please enable Strictly Necessary Cookies first so that we can save your preferences!

| Name | Provider | Purpose | Expiration |

|---|---|---|---|

| visitorID | Adobe | The visitorID cookie, sets a unique ID by collecting information in a way that does not directly identify anyone. This is used for marketing purposes. | |

| App Nexus | .adnxs.com | Used by App Nexus and used to buy, sell, and deliver online advertising, including interest-based advertising, mostly through real-time bidding. | |

| _uetsid | Bing | Bing Ads sets this cookie to engage with a user that has previously visited the website. | 1 day |

| MR | Bing | Bing Ads sets this cookie to engage with a user that has previously visited the website. | 13 months |

| MSPTC | Bing | This cookie allows to serve relevant advertisements to visitors | 1 Year |

| MUID | Bing | Microsoft Bing sets this cookie to identify unique web browsers visiting Microsoft sites. These cookies are used for advertising, site analytics, and other operational purposes. | 1 Year |

| SRCHHPGUSR | Bing | Records actions after you've viewed or clicked an advert to measure its performance and tailor future advertising to you | 4 months |

| SRCHUID | Bing | Records actions after you've viewed or clicked an advert to measure its performance and tailor future advertising to you | 2 months |

| SRCHUSR | Bing | Used to serve relevant advertisements to visitors across the Microsoft Bing network. | 2 months |

| IDE | Doubleclick | Used to measure the conversion rate of ads presented to the user. | 1.5 years |

| test_cookie | Doubleclick | A session cookie used to check if the user’s browser supports cookies. | Session |

| ar_debug | Double Click | DoubleClick sets this cookie to debug and troubleshoot the ads served by DoubleClick. | Session |

| _fbp | To store and track visits across websites. | 3 months | |

| c_user | Stores a unique user ID | 1 year | |

| datr | Facebook sets the datr cookie to avoid creation of fake/spam accounts, account thefts etc. and is thus important for Facebook’s security and site integrity features. | 1 month | |

| dpr | This cookie helps Facebook record the device pixel ratio of your screen and whether or not you’ve enabled high-contrast mode, so that they can render our sites optimally. | 7 days | |

| fr | Facebook sets this cookie to show relevant advertisements to users by tracking user behaviour across the web, on sites that have Facebook pixel or Facebook social plugin. | 1 Year | |

| locale | Facebook sets this cookie to enhance the user's browsing experience on the website, and to provide the user with relevant advertising while using Facebook’s social media platforms. | 3 months | |

| presence | "The presence cookie is used to contain the user’s chat state. For example, which chat tabs are open." | Session | |

| ps_l | This is used to serve targeted advertising to its users when logged into its services. In 2014 it also started serving up behaviourally targeted advertising on other websites, similar to most dedicated online marketing companies. | 1 year | |

| ps_n | This is used to serve targeted advertising to Facebook users when logged into its services. | 1 year | |

| sb | This cookie is used by Facebook to control its functionalities, collect language settings and share pages. | 2 weeks | |

| wd | Facebook sets this cookie to store dimensions of screens and windows and to optimize the page rendering. | 1 month | |

| xs | Used to to store a unique session ID. | 3 months | |

| __Secure-1PAPISID | A Google cookie that collects information about a user's interactions with Google services and ads. It's used to create a user profile and display personalized Google ads. | 2 years | |

| __Secure-1PSIDCC | "a persistent cookie that stores an encrypted timestamp to help maintain user sessions. - Allows users to access Google services and options Maintains user sessions - Preserves user preferences and settings across Google services and websites - Used for user tracking across domains0 - Used for advertising, analytics, or maintaining consistent sessions across services" | 2 years | |

| __Secure-1PSID | Google may set this cookie on your phone, tablet or computer once you click on the YouTube video player. Used to build a profile of website visitor interests to show relevant and personalised ads through retargeting. | 2 years | |

| __Secure-1PSIDTS | A Google cookie that tracks user interactions with Google ads and services. It contains a unique identifier and is used to store user preferences. | 2 years | |

| __Secure-3PAPISID | For targeting purposes to build a profile of the website visitor’s interests in order to show relevant & personalised Google advertising | 2 years | |

| __Secure-3PSID | For targeting purposes to build a profile of the website visitor’s interests in order to show relevant & personalised Google advertising | 1 Year | |

| __Secure-3PSIDCC | A Google cookie that tracks a user's interactions with Google services and ads | 2 years | |

| APISID | A Google cookie that collects user information to personalize ads on Google sites and YouTube videos. It's set when a user clicks on a YouTube video player on their device. | 2 years | |

| ADS_VISITOR_ID | Identifies unique visitors for Google Ads tracking. It's used to: - Identify users who are served advertisements - Prevent spam, fraud, and abuse by ensuring that requests within a browsing session are made by the user - Track visitor interactions with ads across different sessions and devices - Aid in ad performance analysis" | 2 months | |

| AEC | Used to detect spam, fraud, and abuse to help ensure advertisers are not incorrectly charged for fraudulent or otherwise invalid impressions or interactions with ads, and that YouTube creators in the YouTube Partner Program are remunerated fairly. | 6 months | |

| HSID | For targeting purposes to build a profile of the website visitor’s interests in order to show relevant & personalised Google advertising | 2 years | |

| NID | Used by the google reCAPTCHA. These cookies use an unique identifier for tracking purposes | 6 months | |

| SAPISID | A Google cookie that helps Google display personalized ads on Google sites and YouTube. The cookie contains a unique ID that Google uses to remember the user's preferences and other information. Google uses the cookie to build a profile of the user's interests and show them relevant ads | 2 years | |

| SEARCH_SAMESITE | This cookie is used to prevent the browser from sending this cookie along with cross-site requests. | 2 years | |

| SID | These are essential site cookies, used by the google reCAPTCHA. These cookies use an unique identifier for tracking purposes | 2 years | |

| SIDCC | Google may set this cookie on your phone, tablet or computer once you click on the YouTube video player. This is a security cookie that protects the user data from unauthorised access. | 1 year | |

| SSID | Google may set this cookie on your phone, tablet or computer once you click on the YouTube video player. Used to collect visitor information for videos hosted by YouTube on maps integrated with Google Maps. | 2 years | |

| _gcl_au | Google Tag Manager | Google Tag Manager sets this cookie to experiment advertisement efficiency of websites using their services. | 3 months |

| _ga_* | Google Analytics sets this cookie to store and count page views. | 2 years | |

| _ga | The _ga cookie, installed by Google Analytics, calculates visitor, session and campaign data and also keeps track of site usage for the site's analytics report. The cookie stores information anonymously and assigns a randomly generated number to recognize unique visitors. | 2 years | |

| _gid | Installed by Google Analytics, _gid cookie stores information on how visitors use a website, while also creating an analytics report of the website's performance. Some of the data that are collected include the number of visitors, their source, and the pages they visit anonymously. | 1 day | |

| _gat_UA-* | Google Analytics sets this cookie for user behaviour tracking. | 1 minute | |

| PHPSESSID | Response IQ | This cookie is native to PHP applications. The cookie is used to store and identify a users' unique session ID for the purpose of managing user session on the website. The cookie is a session cookies and is deleted when all the browser windows are closed. | Session |

| sa-user-id | Stack Adapt | StackAdapt sets this cookie as a third party advertising cookie to record information about a user's website activity, such as the pages visited and the locations viewed, to enable us to provide users with interest-based content and personalised advertisements on external websites." | 1 year |

| sa-user-id-v2 | Stack Adapt | StackAdapt sets this cookie as a third party advertising cookie to record information about a user's website activity, such as the pages visited and the locations viewed, to enable us to provide users with interest-based content and personalised advertisements on external websites. | 1 year |

| sa-user-id-v3 | Stack Adapt | StackAdapt sets this cookie as a third party advertising cookie to record information about a user's website activity, such as the pages visited and the locations viewed, to enable us to provide users with interest-based content and personalised advertisements on external websites. | 1 year |

| TDID | The Trade Desk | Is a third party cookie that contains a unique randomly-generated value that enables the platform to distinguish browsers and devices. | 1 year |

| TDCPM | The Trade Desk | Trade Desk Cookie Partner Mapping (TDCPM) records which partners The Trade Desk has matched IDs with in order to prevent redundant matching calls. | 1 year |

| _hjSessionUser_xxxxxx | Trust Pilot | Hotjar cookie that is set when a user first lands on a page with the Hotjar script. It is used to persist the Hotjar User ID, unique to that site on the browser. This ensures that behavior in subsequent visits to the same site will be attributed to the same user ID. | 364 days |

| ajs_anonymous_id | Trust Pilot | These cookies are generally used for Analytics and help count how many people visit a certain site by tracking if you have visited before. | 1 year |

| amplitude_id_XXXXX | Trust Pilot | These cookies are set by Amplitude Analytics, which helps to better understand how the website is used. | 3650 days |

| OptanonConsent | Trust Pilot | This cookie is set by the cookie consent solution from OneTrust. It stores information about the categories of cookies the site uses and whether visitors have given or withdrawn consent for the use of each category. This enables site owners to prevent cookies in each category from being set in the users browser, when consent is not given. The cookie has a normal lifespan of one year, so that returning visitors to the site will have their preferences remembered. It contains no information that can identify the site visitor. | 1 year |

| OptanonAlertBoxClosed | Trust Pilot | This cookie is set by websites using certain versions of the cookie law compliance solution from OneTrust. It is set after visitors have seen a cookie information notice and in some cases only when they actively close the notice down. It enables the website not to show the message more than once to a user. The cookie has a normal lifespan of one year and contains no personal information. | 1 year |

| TP.uuid | Trust Pilot | Unique identifier value used by Trustpilot Content Integrity team for fraud & scam detection | 10000 days |

| auth_token | An auth_token cookie for Twitter is a cookie that stores a user's authentication token, which allows them to log in to Twitter. | 5 years | |

| ct0 | This cookie is used for Twitter authentication | 5 years | |

| guest_id | This cookie is for marketing when logged out | 2 years | |

| guest_id_ads | This cookie is for marketing when logged out | 2 years | |

| guest_id_marketing | This cookie is for marketing when logged out | 6 months | |

| kdt | This cookie is to authenticate a known device | 2 years | |

| muc_ads | Twitter sets this cookie to collect user behaviour and interaction data to optimize the website. | 2 years | |

| personalization_id | Twitter sets this cookie to integrate and share features for social media and also store information about how the user uses the website, for tracking and targeting. | 2 years | |

| twid | Used for authentication | 2 weeks | |

| ub-emb | Unbounce | Cookie that tracks Unbounce popup triggers, including whether a user has seen a particular popup. | 180 days |

| _abexps | Vimeo.com | This Vimeo cookie helps Vimeo remember the settings you have made. This could be a preset language, region or user name, for example. In general, the cookie stores information about how you use Vimeo. | 1 year |

| _cfuvid | Vimeo.com | Cloudflare cookie used to enforce rate limiting rules. | Session |

| _uetvid | Vimeo.com | This cookie collects information about your actions on websites that have embedded a Vimeo video | 1 year |

| vuid | Vimeo.com | Vimeo-generated ID used for generating analytics information for the video owner. | 2 years |